Key takeaways

- An offset account lets you park your pay and allowances right next to your home loan, so every pound sitting there cuts down the interest you pay each day. Plus, you can still tap into the money whenever you like.

- A redraw facility tucks away any extra repayments you’ve made, keeping them out of sight so you’re less tempted to spend. But you’ll need to ask the bank to access it when you need a top-up.

- You can actually use both together. It gives you the daily interest savings of an offset account and the peace of mind of a redraw buffer, which is spot on for Defence life when postings and pay can change in a flash.

When you’re serving in the ADF, your life tends to move fast new postings, changing pay, deployments, and a whole lot of structure. So when it comes to your ADF home loan, you want it working just as efficiently as you do.

That’s where offset accounts and redraw facilities come into play. They’re both designed to help you reduce interest on your home loan and pay it off faster, but they operate in different ways.

Understanding the difference can help you save thousands and make smarter use of your Defence benefits, like DHOAS or deployment allowances.

What’s an offset account?

An offset account is a separate everyday transaction account that’s linked to your home loan. It looks and functions like your regular bank account. You can have your pay and allowances go into it, use a debit card, pay bills, and so on.

The bonus part is that every dollar sitting in your offset account reduces the amount of your home loan that gets charged interest.

Here’s an ADF example. Let’s say your loan is $500,000 and you’ve got $25,000 in your offset from a recent deployment or leave payout. You’re only paying interest on $475,000, not the full loan.

That means less interest, more control, and your money is working harder even while you’re posted away or overseas.

What’s a redraw facility?

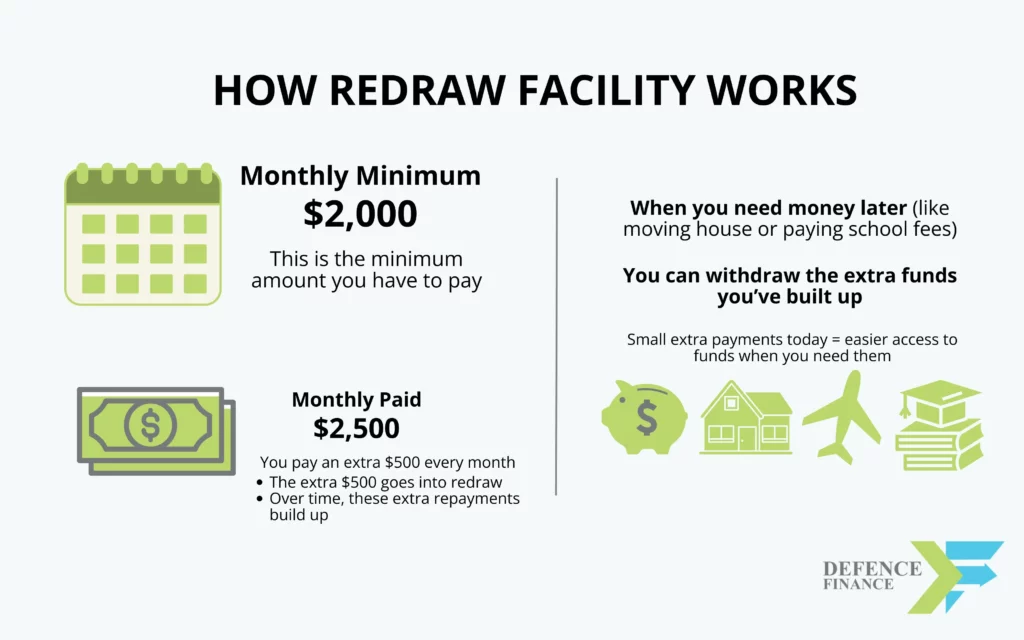

A redraw facility lets you access extra repayments you’ve made on your home loan over and above the minimum.

So if your minimum repayment is $2,000 a month and you pay $2,500, that extra $500 builds up in redraw. Later down the track, maybe during a posting move or when school fees hit, you can access those funds.

It’s not as flexible as an offset, where you usually must request a redraw or transfer. But it’s great for building a buffer without the temptation to spend.

Redraw vs offset: What’s better for the ADF lifestyle?

| Feature | Offset Account | Redraw Facility |

| Works like a regular bank account? | ✅ Yes | ❌ No |

| Reduces interest on your loan? | ✅ Yes (on daily balance) | ✅ Yes (on extra repayments only) |

| Access to funds while deployed or posted? | ✅ Easy with online banking or a card | ⚠️ Slower – may require manual request |

| Good for managing lump sum pay (e.g. deployment, tax-free leave)? | ✅ Yes | ✅ Yes – if disciplined |

| Encourages saving discipline? | ⚠️ Depends on habits | ✅ Yes — funds are “out of sight” |

| Suits an active service lifestyle? | ✅ Yes — daily flexibility and access | ✅ Yes — set and forget |

| Fees? | ⚠️ Sometimes higher due to package loans | ✅ Often lower or included in basic loans |

Redraw vs offset — Which option suits you?

Go for an offset account if:

- You’re regularly moving or deployed and need easy, flexible access to funds.

- You want your pay and allowances working for you every day, every dollar.

- You prefer to keep your savings and spending in one place.

Go for a redraw facility if

- You want to make extra repayments and build up a safety net without seeing it daily.

- You’re unlikely to need access to the funds quickly.

- You like the idea of “out of sight, out of mind” to keep your loan shrinking.

Can you use both redraw and offset?

Absolutely. Many Defence members do.

You might:

- Keep your salary and DHOAS subsidy in the offset account to reduce daily interest.

- Pay a little extra each month into your loan and let it build up in redraw as a long-term buffer.

Using both features gives you flexibility now and security later, which is ideal in a career where things can change quickly.

Make the most of your defence home loan now

Your home loan should adapt to your Defence career, not the other way around. Offset and redraw are tools that can help you manage your money smarter, reduce interest, and stay financially ahead, whether you’re at home, on base, or deployed overseas.

Not sure which one you have or how to set one up? Speak with a Defence-friendly mortgage broker or lender who understands posting cycles, DHOAS eligibility, and the way your pay works. Having someone who knows the ins and outs of a defence home loan lets you build a strategy that fits your unique life in service.